cryptocurrency tax calculator australia

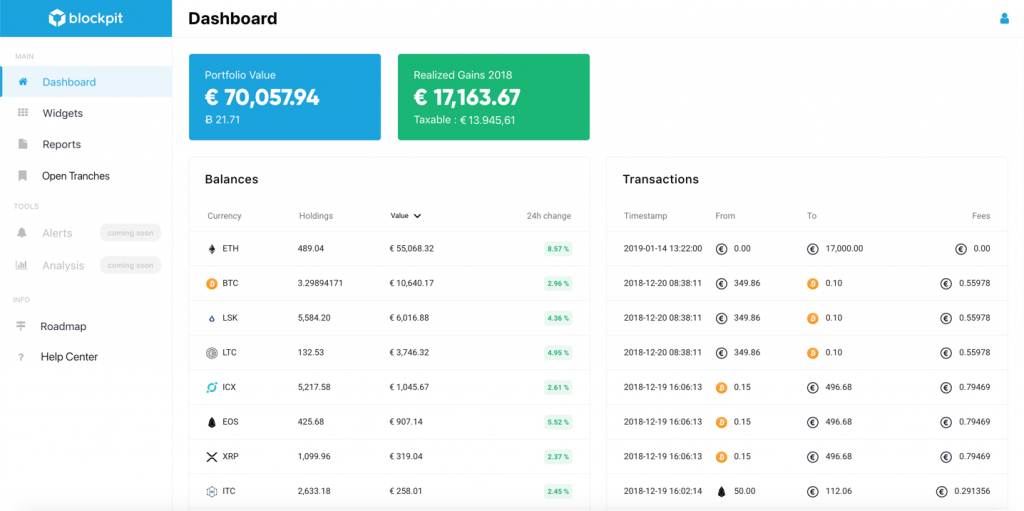

You can import data for all the cryptocurrencies you have traded with and our application will. Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web.

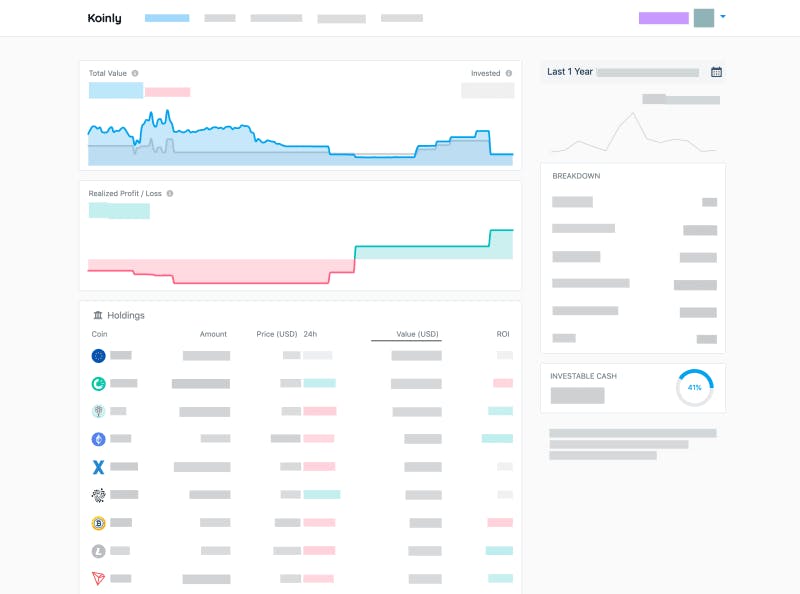

Koinly Crypto Tax Calculator For Australia Nz

Assessable Income Income Capital Gains Deductions.

. ATO has a sliding scale of individual tax rates that you can use to determine the tax owed. Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Swyftxs cryptocurrency tax calculator Australia gives you an estimate of what tax youll pay on profit made from a crypto sale.

This platform directly imports data from crypto wallet merchants. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance.

Income - Tradings GainsLosses Deductions. Crypto Tax Calculator Australia offers a tax calculator application to help you calculate the taxes you need to pay on your. For more videos like this view the Playlist on our Channe.

It provides users with an extremely user-friendly app which can be connected to all of their exchange platform accounts to seamlessly pull all the necessary transaction history data needed to get an accurate overview of the users tax slots. For it brilliant data analyzing ability it won the Product Hunt Global Hackathon in 2017. The tax body said it would require Australians dealing in.

Gifting cryptocurrency to another person is taken to be a disposal and therefore CGT applies. The formula for calculating accessible income is Income Capital Gains Deductions. Its unclear when 3iQs money will be available but with the announcement of the Cosmos and 21Shares funds listings this week its unlikely 3iQ will win the race to become Australias first cryptocurrency ETF.

ATO How to minimize cryptocurrency taxes. As a cryptocurrency investor the amount of tax you pay is based on your overall assessable income. The resulting number is your cost basis 10000 1000 10.

This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements. However your sale price will be a little different. After importing your trades CoinTracking calculates the gainslosses for every trade according to the accounting method used in Australia.

If you hold for a year youll pay 50 less capital gains tax on crypto gains. Assessable income is calculated by. To calculate your capital gain you can use the formula Capital GainLoss Sale price - Cost base.

Tax treatment of cryptocurrencies. Take the initial investment amount lets assume it is 1000. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. At Etax we want to help you understand how cryptocurrency investments are taxed so we put together. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly.

Disposing of cryptocurrency purchased with fiat currency a currency established by a countrys government regulation or law Tim purchased 400 USD Tether USDT for A800. TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange. TokenTax is a crypto tax management company that was founded by Alex Miles back in 2017.

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. Cryptocurrency tax rate. CoinTracking is the best crypto tax software for Australian traders making it easy to import all your trades from 110 exchangeswallets including DeFi and NFTs.

Crypto Tax Calculator for Australia. Cryptocurrency generally operates independently of a central bank central authority or government. If you are a cryptocurrency investor your tax rate will be determined by your overall assessable income based on Australias sliding scale of individual tax rates.

1 day agoThe Australian Taxation Office ATO has announced its plan to start focusing on cryptocurrency taxation. For cryptocurrency traders the formula differs a bit. In Australia youll pay Capital Gains Tax and Income Tax on your crypto investment.

In our Australian crypto tax guide we break down everything you need to know about crypto taxes including what you need to provide when you lodge your crypto tax return with Etax. Individual investors pay capital gains tax on cryptocurrency at the same rate they do their regular income tax which can go to as low as 0 for income under AU18200 US12700 or. If youre classed as a cryptocurrency investor youll be taxed on any capital gains resulting from your crypto transactions.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. Plus some tips on how to make your life easier at tax time. However its best to speak to a tax accountant who specialises in cryptocurrency for further advice.

2019 - 2022 Crypto_Tax. ATO Tax Reports in Under 10 mins. Heres an example of how to calculate the cost basis of your cryptocurrency.

To calculate your capital gainloss simply use the formula Capital GainLoss Sale price - Cost base. The percentage of Capital Gains Tax youll pay is the same as your personal Income Tax rate starting only from earnings above 18201. Hold for more than 12 months.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

30 Off Crypto Tax Calculator 1 Year Subscription Rookie 29 40 Hobbyist 76 20 Investor 149 40 Trader Compare Cards Credit Card Benefits Student Rewards

Crypto Tax In Australia The Definitive 2021 2022 Guide

How To Calculate Crypto Tax In Australia Youtube

Ato Tax Rates For Crypto Bitcoin 2022 Koinly

Convert Bitcoin To Aud Cashout Bitcoins To Australian Dollars Buy Cryptocurrency Bitcoin Cryptocurrency

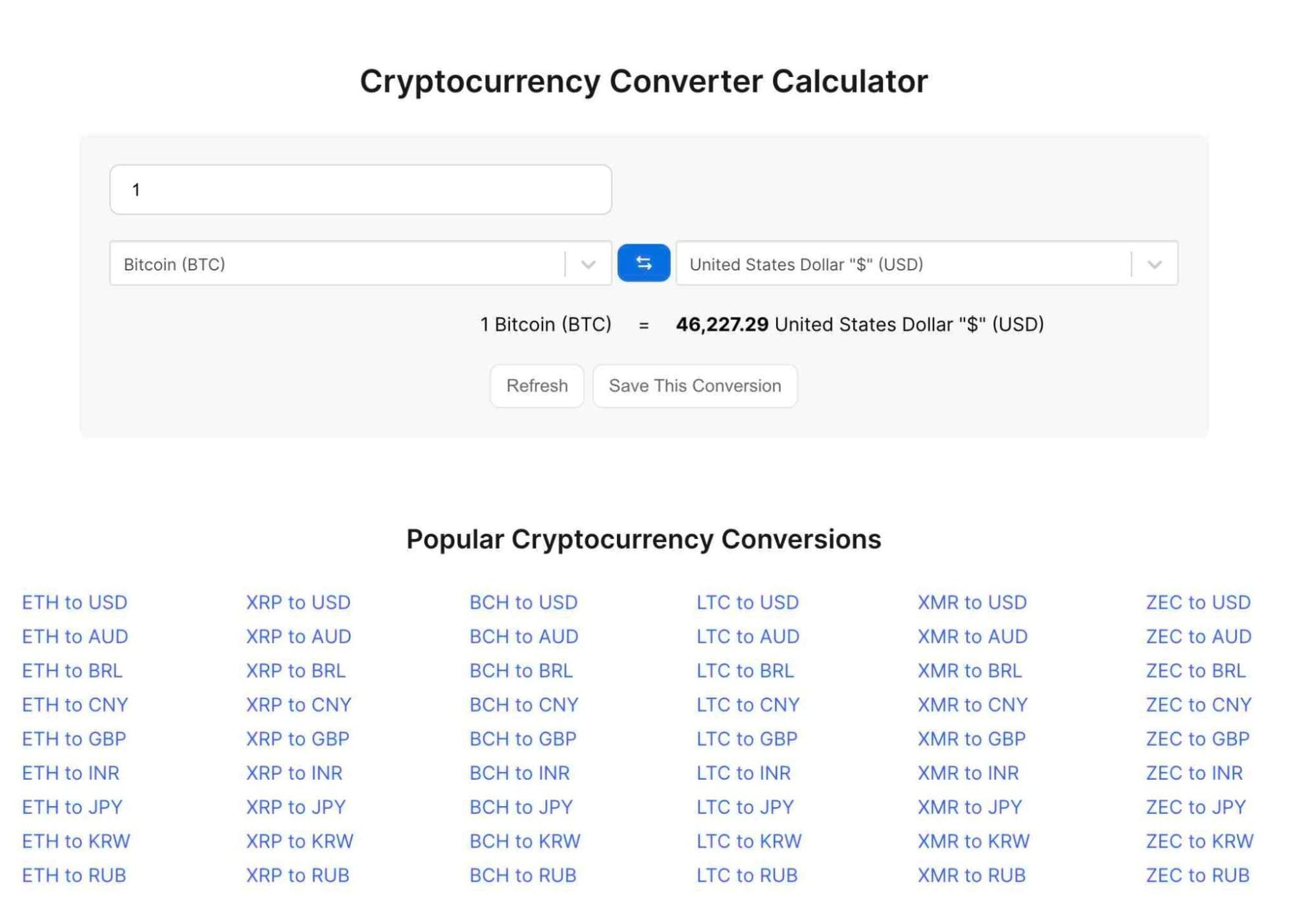

Best Cryptocurrency Calculator Mining Profit Taxes

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

![]()

Cointracking Crypto Tax Calculator

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

How To Calculate Crypto Taxes Koinly

Australia Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

How To Buy Cryptocurrency In Australia Buy Cryptocurrency Bitcoin Cryptocurrency

![]()

Cointracking Crypto Tax Calculator

![]()

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda